Turning Social Data Into Smart Capital

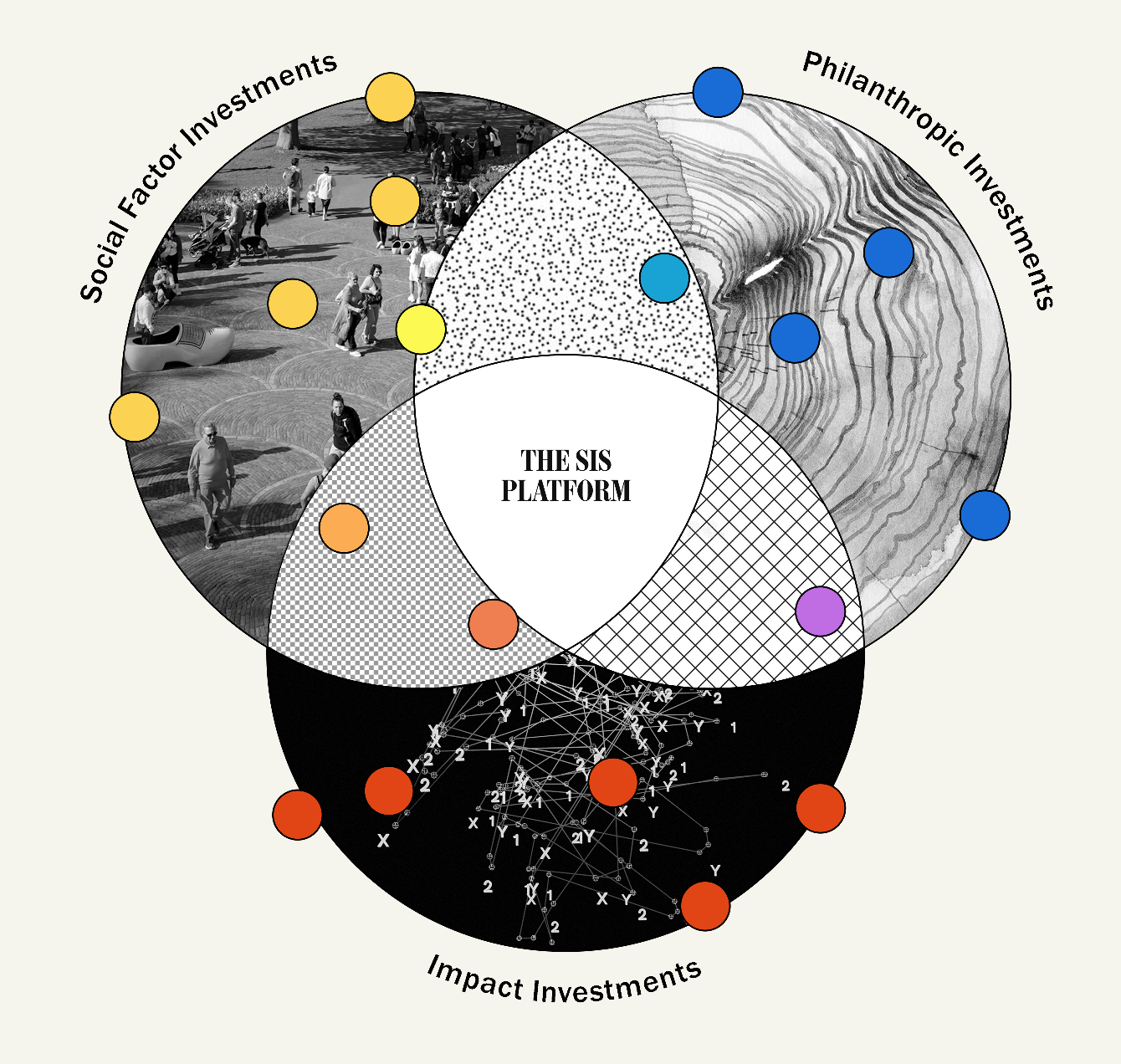

We work with impact organizations, funders, and conveners to support impact and financial goals.

SIS is developing solutions across the capital spectrum to meet impact and financial return preferences.

The Blind Spots of Social Factor Analysis

SIS uses proprietary technology to transform unstructured social data into standardized, verifiable insights. Applications built on this engine enable data-driven decisions, seamless impact integration into capital allocation strategies, and more effective funding to impact organizations.

Provide clients with transparent social data and benchmarks to integrate philanthropy, impact investing & socially responsible investing into wealth plans.

Enable coordinated impact funding and gain actionable visibility into Social Return on Investment across programs, portfolios, and cross-sector initiatives.

Streamline reporting and fundraising with a platform that structures existing social data for grant applications, investor updates, and impact measurement.

Maximize financial returns, social impact, or both.

Provides flexibility and insight for investors seeking to balance social and financial returns. The SIS Platform offers pre-vetted impact investment funds with structured financial and social data, enabling investors to align capital with their risk-return preferences while ensuring measurable impact at both the company and fund level.

The SIS Engine enables social investors

to make data-driven decisions with confidence across

finance and philanthropy.

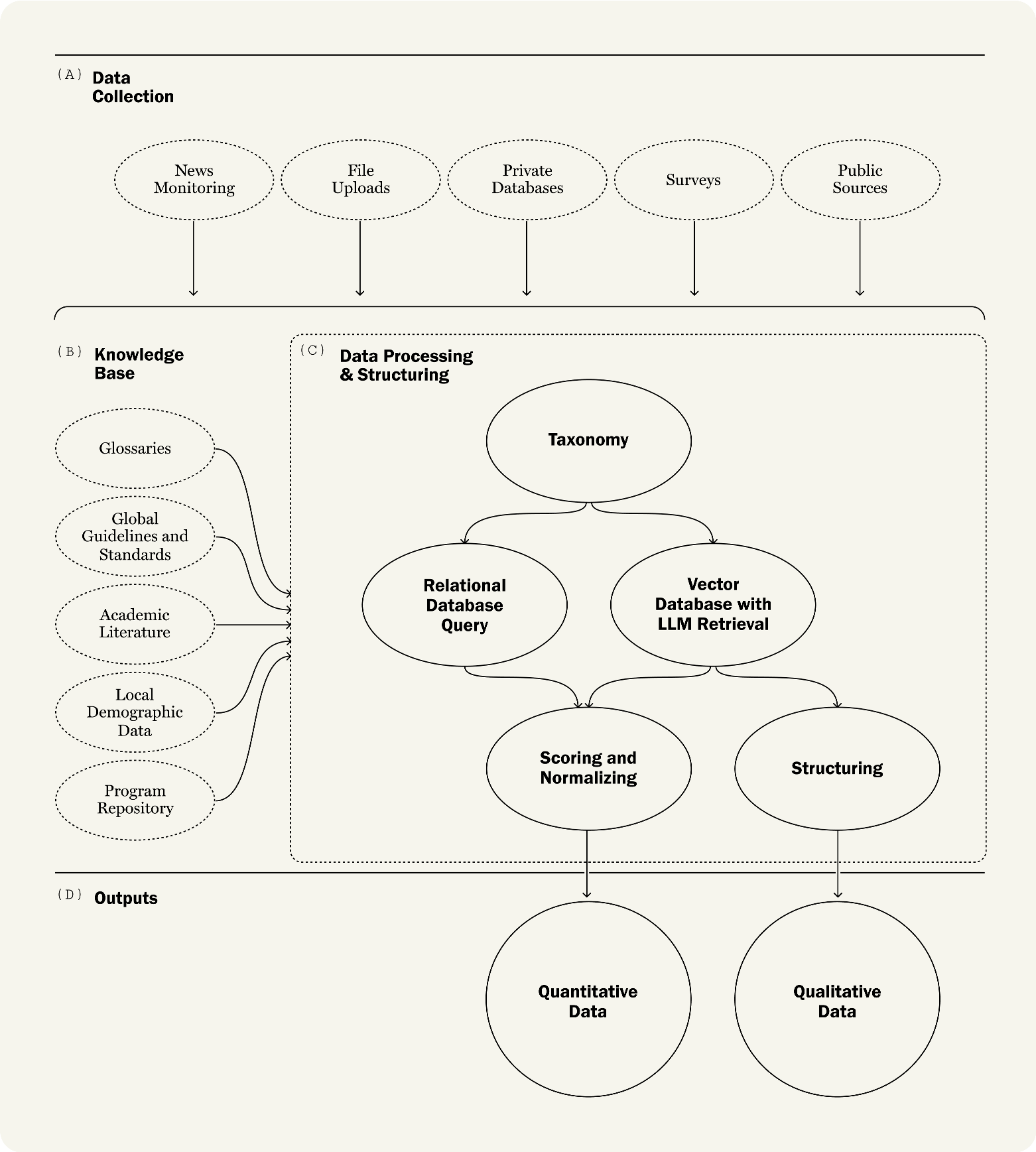

(A) Data Collection

The SIS Engine ingests data from government databases, regulatory filings, direct uploads, and other sources, ensuring that retrieved insights align with the taxonomy’s framework.

(B) Knowledge Base

The knowledge base serves as a central reference system, ensuring consistency, alignment with global standards, and validation of accuracy and comprehensiveness in social data analysis.

(C1) Taxonomy

The taxonomy defines what data to collect and how to assess it, providing a structured framework for analysis. Designed to be dynamic, it evolves to reflect shifts in materiality and scope, ensuring relevance and adaptability.

(C2) Vector Database with LLM Retrieval

The vector database stores unstructured data throughout the data ingestion process. Using LLMs, it identifies and extracts the most relevant insights aligned with the taxonomy, ensuring precise and contextualized summaries for each impact organization.

(C3) Relational Database Query

The relational database stores structured data collected during the ingestion process. Using traditional queries, it calculates quantitative metrics mapped to the taxonomy.

(C4) Relational Database Query

The relational database stores structured data collected during the ingestion process. Using traditional queries, it calculates quantitative metrics mapped to the taxonomy.

(C5) Structuring

Qualitative information that is relevant for search and comparison and may not be relevant for scoring is structured based on the taxonomy.

(D) Outputs: Quantitative & Qualitative Data

Quantitative data is sourced from traditional databases or extracted using LLMs, generating measurable impact indicators that offer clear, numerical benchmarks for analysis. Qualitative data is structured using the SIS taxonomy and LLMs, allowing for standardized analysis across organizations. Rather than assigning scores to inherently subjective social data, SIS provides a framework for evaluating organizations based on structured insights.